Apple will be releasing its fourth-quarter and full-year earnings for 2025 on October 30. Here’s what to expect, what happened in the quarter, and what Wall Street is predicting.

The results of Apple’s fourth fiscal quarter will be detailed in a release on October 30. It will be issued a short time before the traditional investor and analyst conference call, which will happen at 5PM Eastern time.

As usual, the call will consist of CEO Tim Cook and CFO Kevan Parekh discussing the quarter’s digits, as well as guidance for future quarters. It also has the two executives taking questions from analysts, who will almost certainly be discussing topics such as the iPhone 17 launch.

As usual, AppleInsider will be listening to the conference call and reporting the financial results in full as they are released.

Last quarter: Q3 2025

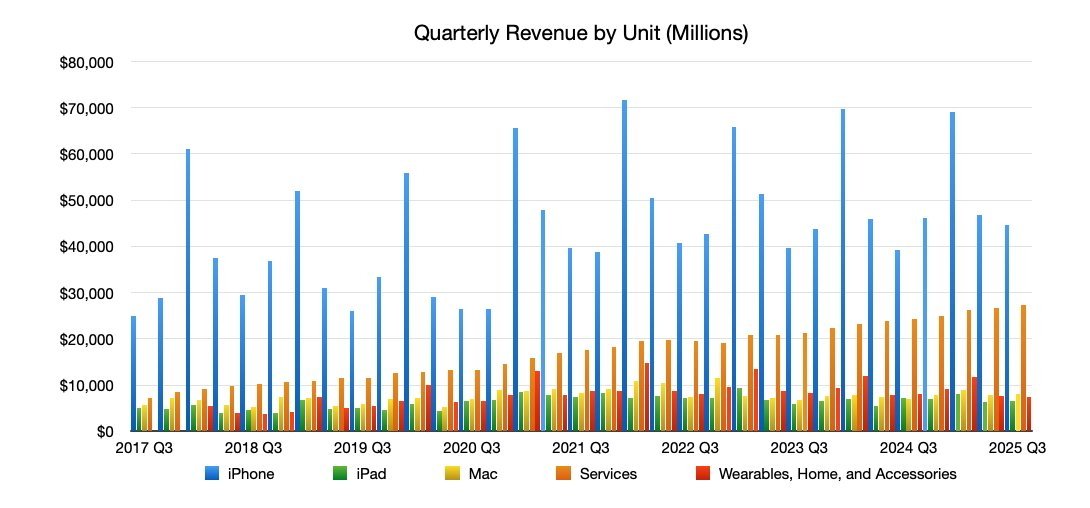

The Q3 2025 financial results saw Apple reach a revenue of $94.04 billion, up from Q3 2024’s $85.78 billion. The earnings per share was also up, reaching $1.57.

For the period, iPhone revenue grew to $44.58 billion, iPad revenue shrank to $6.58 billion, and Mac revenue grew to $8.05 billion. Wearables, Home, and Accessories also shrank to $7.4 billion for the quarter, but Services maintained its growth at $27.4 billion.

At the time, Apple said its install base had reached a new all-time high across all product categories and geographic segments. This was attributed by Parekh to “very high levels of customer satisfaction and loyalty.”

The board of directors declared a cash dividend of $0.26 per share of the company’s common stock.

Year-ago quarter: Q4 2024

The Halloween 2024 Q4 financial results call did extremely well, soundly beating Wall Street predictions.

In the fourth quarter, Apple achieved $94.93 billion in revenue, up from the $89.5 billion it reported in Q4 2023. The earnings per share was also declared at $1.64.

iPhone revenue was $46.22 billion, up 5.5% on the previous year’s figures. iPad was also up 7.9% to $6.95 billion, while Mac grew 1.7% to $7.74 billion.

Wearables, Home, and Accessories was the only blemish in the figures, decreasing 3% to $9.32 billion. Services continued to be growth-centric, going up 11.9% to $24.7 billion.

During the quarter, Apple launched the iPhone 16 range, AirPods Max with USB-C, the Apple Watch Series 10, and a new black colorway of the Apple Watch Ultra 2.

What happened in Q4 2025

The Q4 2025 quarter takes into account Apple’s sales and activities in July, August, and September.

In the Q3 conference call, Apple warned that tariffs could add about $1.1 billion to its Q4 costs. By August, thanks in part to a gold and glass commemorative plaque and another $100 billion U.S. manufacturing investment pledge, it narrowly escaped a 100% import tax on semiconductors.

July also brought with it the announcement that Jeff Williams would be replaced as COO by Sabih Khan. AppleCare One was also launched, allowing customers to cover three devices with one flat-rate monthly plan.

The first Apple Manufacturing Academy was launched in August, as well as the opening of a third Apple Store in Shenzhen, China. Meanwhile Apple TV+ was the subject of a price hike.

September had Apple’s usual product launch event, which introduced the iPhone Air alongside the iPhone 17 range, the Apple Watch Series 11, the Apple Watch Ultra 3, and AirPods Pro 3. The launch controversy for 2025 was how apparently easy the iPhone 17 Pro models could scratch.

While there were launches in the month, they won’t have a massive effect on the quarter’s results since they became available in the last few weeks of the period. They will, however, have a more meaningful impact on the Q1 2026 results.

Wall Street consensus

The Wall Street consensus refers to a survey of analysts. The results are averaged out to give a general opinion of where investors and analysts are leaning in their quarterly forecasts for Apple.

Yahoo Finance

In the estimates published by Yahoo Finance as of October 22, 30 analysts offered an average revenue estimate of $102.09 billion. The estimated range goes from a high of $107.79 billion to a low of $97.85 billion.

For the earnings per share, a group of 31 forecasts an average of $1.76, with a high of $1.83 and a low of $1.59.

TipRanks

On October 22, TipRanks offered its own consensus figures. The revenue forecast is at $102.01 billion, with a range from $97.85 billion to $107.79 billion. The earnings per share is expected to be $1.77, with a range from $1.57 to $1.83.

Analyst expectations

Ahead of the results and call, analysts offer their own forecasts of what they think Apple will be declaring in its financials. Depending on the firm and the analyst, these hot takes include both positive and negative opinions about Apple.

Wells Fargo

In an October 21 note to investors, Wells Fargo raised its price target for Apple from $245 to $290, while maintaining an “Overweight” rating.

The change was accompanied by speculation that Apple will reach Q4 revenue of $102.4 billion, with a quarterly earnings per share of $1.79.

The firm viewed Apple’s AI strategy will rectify itself and make AI “mainstream” to users in the future. Apple is thought to be “well-positioned” to bring more AI features to is devices, and that should help stir up investor confidence.

Goldman Sachs

Goldman Sachs similarly raised its own target on October 21, but at a somewhat smaller level, from $266 to $279. It reiterated a “buy” recommendation for the shares at the time.

The revenue should be at around $103.5 billion, the firm feels, with an earnings per share of $1.81.

Revenue growth should remain strong despite an apparent slowdown in App Store sales growth. However, there should be double-digit growth for iCloud, Apple Care+, Apple Pay, and other subscription services.

Demand for the iPhone is anticipated to be strong, thanks to competition among U.S. mobile networks.

Wedbush

On October 21, Wedbush said it would maintain an “Outperform” rating for Apple with a price target of $310. It projected Q4 revenue of $101.69 billion, and an earnings per share of $1.76.

Apple had finally “found success with iPhone 17,” the note to investors read, and that it was in a great position to provide a meaningful update to its AI roadmap. With AI monetization properly put in place, it could add another $75 to $100 to the share price in the coming years, which isn’t factored into current share prices.

Morgan Stanley

In a note to investors seen by AppleInsider on October 22, Morgan Stanley kept its price target at $298, citing a need for more information from suppliers and Chinese shopping festival results.

iPhone 17 demand has already raised Apple’s stocks, which should continue through to the end of 2025, the note reads. However, the analysts downplay how much Apple could beat Wall Street expectations by, even with the continued rise in Services.

It conservatively raised its September quarter forecast to 56.9 million iPhones sold, a raise of 2 million units.

JP Morgan

In a note to AppleInsider on October 27, JP Morgan hiked its stock target for Apple from $280 to $290. Analysts put the raise primarily on increased confidence in the iPhone product cycle, alongside some more modest existing gains.

For the short term, JP Morgan predicts $103 billion in overall revenue for the quarter. Sales from iPhone should hit $50.2 billion, with Mac, iPad, and Services also expected to see positive increases over the consensus.

Into the first quarter of 2026, JP Morgan anticipates bigger things from Services, in part because of how well the iPhone 17 range is doing. The growth will help moderate the impact of tariffs on Apple’s earnings.

TD Cowen

In its own October 27 note seen by AppleInsider, TD Cowen lists expectations for Apple to report overall revenue of $101.3 billion for the quarter, with an earnings per share of $1.75.

The iPhone revenue of $50 billion for the quarter are based on forecasts of 53 million units for the period, growing to 76 million in the December quarter. Services will grow 13% year-on-year to $28.2 billion, and continue to sustain low double-digit percentage growth into 2026.

Mac revenues were strong, but supply chain checks were trimmed recently, leading to a revised forecast of 5.5 million and 6 million units in calendar Q3 and Q4, respectively. Broadly, for non-iPhone hardware revenue, TD Cowen models the third quarter as being about 3% down year-over-year, but Q4 to be up 2% year-over-year.

As more analysts chime in, we’ll be adding to this post.

Trending Products

Apple iPhone 12 Mini – Parent...

Apple iPhone SE 2nd Gen – Par...

Apple iPhone 7 32GB Unlocked AT&...

Apple iPhone 14 – Parent (Ren...

Apple iPhone 12 Pro Max, PARENT (Re...

Apple iPhone 8 64GB Unlocked –...

Apple iPhone 15 Plus 5G (512GB, 6GB...

Apple iPhone 14 Pro (Renewed)

Apple iPhone 15 Pro Max – Par...